If an expense is nonessential, that means you can cut it in pursuit of other goals. You might not incur the costs every month, but they’re big ones that you’ll want to save for and schedule.Ĭut or limit nonessential expenses as necessary.

You’re also going to need to pay for maintenance.

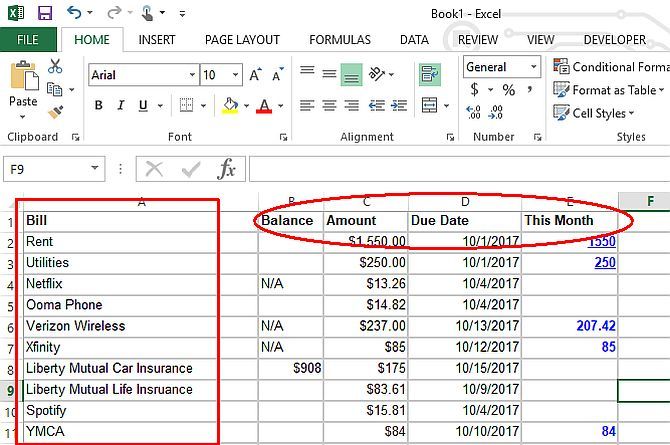

For example, if you need a car to get to work, every year you’re going to need to pay to get that vehicle inspected. These are expenses that you cannot live a healthy life without.Įssential expenses may occur every month, or they may be more irregular. In addition to these categories, you’ll want to tag each expense as either “Essential” or “Nonessential.”Įssential expenses include things like rent, mortgage, groceries, and utility bills. You can categorize them into groups such as: Now that you know what your expenses are, you’ll want to categorize them.

#How to create a home budget spreadsheet software#

You can simply download your statements from your financial institutions for the last three months, or import them using your favorite budgeting software or app. You don’t have to wait until three months from now to write your budget, though. Ideally, you’ll track your spending for at least three months. This will help remind you of the bills you pay on a monthly basis, identify bills you might be able to negotiate, and help you understand how much all those innocent-seeming $5 purchases you make here and there throughout the week can really add up. That’s why it is imperative to track your spending habits. Before you can change what you’re doing, you need to be aware of it. That’s a big part of it.īut at the end of the day, you’re not going to meet your financial goals if you don’t actually change what you’re doing. Sure, it’s about numbers and spreadsheets, too. Track your spending habitsīudgeting is all about modifying your behavior. Whatever your budgeting goals are, if you identify them before you start, it will help you prioritize your spending later on in the process. You might want to retire early or simply be able to go on a family vacation every year. Maybe you want to leave the paycheck-to-paycheck cycle behind. What was that event, and what about it motivated you to your money right? Odds are there was a defining event that led you to sit down and make a budget.

0 kommentar(er)

0 kommentar(er)